For more than a decade, cryptocurrency mining has been one of the most debated and dynamic industries in the digital economy.

Once a gold rush for early adopters, it has evolved into a high-tech, high-cost global operation.

As we enter 2025, the question on many investors’ minds is simple but crucial: Is crypto mining still worth it?

The answer depends on where you live, what you mine, and how you adapt to the new realities of energy efficiency, regulation, and AI-assisted optimization.

The Evolution of Mining: From Hobby to Industrial Powerhouse

In Bitcoin’s early days, mining could be done on a personal laptop. Rewards were generous, competition was low, and electricity costs were barely a concern.

Today, the landscape looks completely different. Mining has become an industrial-scale operation dominated by data centers, renewable energy hubs, and sophisticated hardware — the kind of business where small inefficiencies can mean massive losses.

The introduction of ASICs (Application-Specific Integrated Circuits) and the rise of mining farms in regions with cheap energy — from Texas to Kazakhstan — have reshaped the ecosystem.

But so has something else: global energy policy.

As governments push for carbon neutrality and stricter environmental standards, miners are being forced to innovate — or disappear.

Energy Efficiency and the Green Mining Revolution

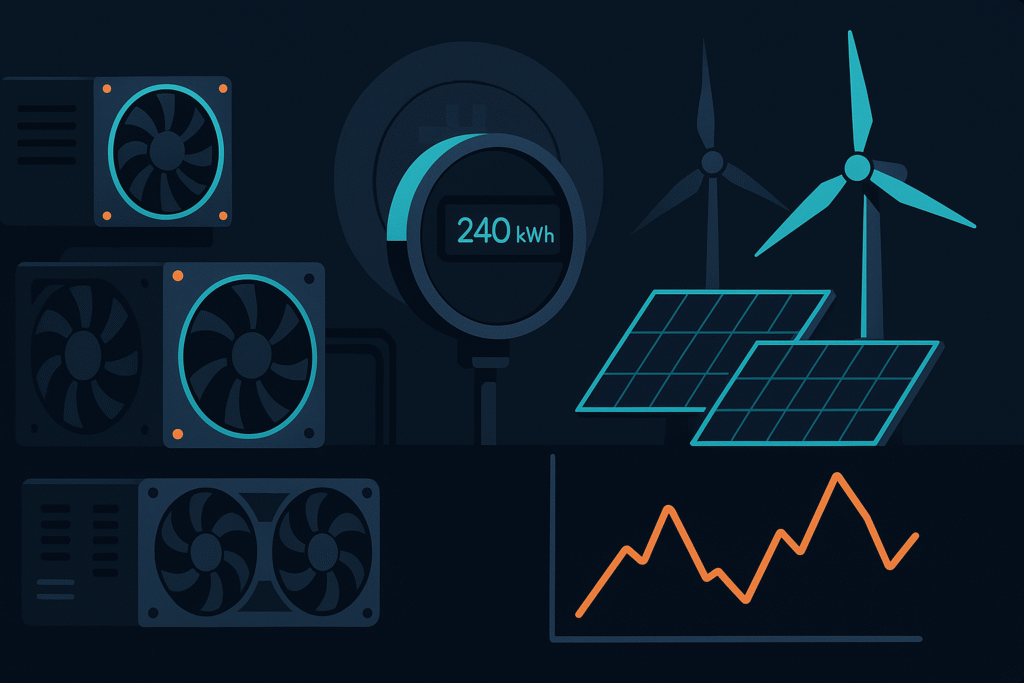

One of the biggest shifts in 2025’s mining industry is the move toward sustainable energy sources.

The old narrative of “Bitcoin wastes electricity” is fading as miners increasingly turn to solar, hydro, and wind power.

Companies in the U.S., Canada, and Northern Europe are setting up mining facilities powered entirely by renewables, often partnering with local energy providers to stabilize grids and reuse excess power.

Even developing nations are joining the movement. In Africa and South America, mining farms are being built near hydroelectric dams or geothermal plants, converting wasted energy into digital assets.

The concept of “green mining” is no longer a niche — it’s a competitive advantage.

Meanwhile, AI-driven optimization software now monitors temperature, power draw, and hash rate in real-time, squeezing every bit of efficiency from hardware to maintain profitability in tighter markets.

Bitcoin Halving and Its Impact on Profitability

Every four years, Bitcoin’s protocol cuts mining rewards in half — an event known as the Halving.

The most recent halving in 2024 reduced block rewards from 6.25 to 3.125 BTC, instantly affecting miners’ income.

While historically halvings have driven Bitcoin’s long-term price up, the immediate aftermath always squeezes miners — only the most efficient survive.

By 2025, miners are relying on:

- Lower energy costs through renewable integration.

- Advanced ASIC models with record-breaking hash rates per watt.

- Dual-income setups, combining Bitcoin mining with heat recovery systems or computing services.

Example: Some mining facilities now use the heat generated by ASIC machines to power nearby greenhouses or industrial systems — turning waste into profit.

So, is it still profitable?

For large, efficient operations — yes.

For small-scale hobbyists — only if electricity costs are minimal or free.

The Rise of Alternative Coins and AI Mining

As Bitcoin mining consolidates, smaller miners are pivoting toward altcoin mining, where competition is lower and entry barriers smaller.

Projects like Kaspa (KAS), Ergo (ERG), and Flux (FLUX) have gained popularity among GPU miners, offering new profitability models and community-based support.

AI has also entered the game.

New machine-learning algorithms can automatically switch mining rigs to the most profitable coins based on network difficulty and market price, ensuring that miners never miss opportunities.

Platforms like NiceHash AI, HiveOS Smart Mining, and Minerstat offer real-time optimization and cloud-based monitoring — helping smaller players stay competitive without complex manual configurations.

In 2025, success in mining isn’t just about having the biggest machines — it’s about having the smartest system.

Regulation and Taxation: The New Reality

As crypto moves into mainstream finance, governments are no longer ignoring mining.

Countries like the U.S. and Canada have introduced specific tax frameworks for mining income, requiring clear accounting of energy costs, rewards, and capital depreciation of equipment.

Meanwhile, regions with cheap but unstable power — such as Kazakhstan or Iran — have introduced licensing systems and export limits to control grid usage.

While this makes mining more bureaucratic, it also adds legitimacy.

Institutional investors are more likely to fund or partner with regulated mining operations, especially those certified as carbon-neutral or compliant with ESG (Environmental, Social, Governance) standards.

Mining is no longer a backroom hustle — it’s becoming a regulated, transparent industry at the intersection of finance, energy, and technology.

The Future of Mining: Beyond Proof-of-Work

While Bitcoin remains the dominant proof-of-work (PoW) network, the future of mining might look very different.

Other models like Proof-of-Stake (PoS), Proof-of-Space, and Proof-of-Useful-Work are gaining attention.

These new systems reward contributors for providing computational power for real-world applications, such as scientific simulations or AI model training, instead of just solving mathematical puzzles.

This hybrid model could redefine what “mining” means — turning blockchain networks into distributed computing platforms with measurable global benefits.

Final Thoughts: Adapt or Exit

So, is crypto mining still worth it in 2025?

The answer is yes — but not for everyone.

Mining has matured from a wild experiment into a capital-intensive, high-efficiency business.

Those who embrace renewable energy, AI automation, and diversified strategies are thriving.

Those clinging to outdated hardware or unsustainable electricity models are slowly fading away.

In the end, mining is no longer about raw power — it’s about smart power.

The industry’s future won’t be written by those who mine the most, but by those who mine the smartest, cleanest, and most efficiently.